On April 28, 2017, Governor Brown signed Senate Bill 1 (SB1) (Beall, Chapter 5, Statutes of 2017), which is also known as the Road Repair and Accountability Act (RMRA) of 2017. This Act provides the first significant, stable, and ongoing increase in state transportation funding in more than two decades. In providing this funding, the Legislature has provided additional funding for transportation infrastructure, increased the role of theCalifornia Transportation Commission(CTC) in a number of existing programs, and created new transportation funding programs for the CTC to oversee.

The purpose and intention of the Act is to address basic road maintenance, rehabilitation, and critical safety needs on both the state highway and local streets and road systems as well as provide transit assistance.

SB1 affected eight different transportation funding programs (listed below) that required the California Transportation Commission (CTC) to develop requirements and guidelines for their implementation. These programs are in addition to the State Transit Assistance Program, which is not administered by the CTC.

SB1 - CTC Programs

(Statewide funding noted in parenthesis)

- Local Streets and Roads (approximately $1.5 billion per year)

- Active Transportation Augmentation ($100 million per year)

- Local Partnership Program ($200 million per year)

- STIP (approximately $110 million per year)

- Solutions for Congested Corridors ($250 million per year)

- Trade Corridor Enhancement Account ($300 million per year)

- Traffic Congestion Relief Program (approximately $90 million, one time only)

- SHOPP (approximately $1.9 billion per year)

View the California Transportation Commission SB1 webpage.

Funding Sources

The State of California imposes per-gallon excise taxes on gasoline and diesel fuel, sales taxes on diesel fuel, and registration taxes on motor vehicles and dedicates these revenues to transportation purposes. Portions of these revenues flow to cities and counties through the Highway Users Tax Account (HUTA) and the newly established RMRA account created by SB 1.

The Local Streets and Roads Funding Program administered by the CTC in partnership with the State Controller are supported by RMRA funding which includes portions of revenues from the following sources:

- An additional 12 cent per gallon increase to the gasoline excise tax effective November 1, 2017.

- An additional 20 cent per gallon increase to the diesel fuel excise tax effective November 1, 2017.

- An additional vehicle registration tax called the "Transportation Improvement Fee" with rates based on the value of the motor vehicle effective January 1, 2018.

- An additional $100 vehicle registration tax on zero emissions (ZEV) vehicles of model year 2020 or later effective July 1, 2020.

- Annual rate increases to these taxes beginning on July 1, 2020 (July 1, 2021 for the ZEV fee) and every July 1st thereafter equal to the change in the California Consumer Price Index (CPI).

Roughly half of the balance of revenues deposited into the RMRA, after certain funding is set aside for various programs, will be continuously appropriated for apportionment to cities and counties by the Controller.

The State Controller's office will apportion the FY 2017-18 funding to Cities and Counties starting in Mid-January 2018.

Local Benefits of Senate Bill 1

The City anticipates receiving approximately $30 million in funding over the next 5 years through various SB1 funded grant programs. The SB1SB1 Fact Sheetsummarizes what projects have been completed or are scheduled in the next 5 years with SB1 funds.

The City currently qualifies to receive funding through the Local Streets and Roads Program. The objective of the Local Streets and Roads Program is to address deferred maintenance on the local streets and roads system through the prioritization and delivery of basic road maintenance and rehabilitation projects as well as critical safety projects. The new transportation funding will help cities and counties address years of differed maintenance. In addition, cities and counties may also use these funds for critical safety projects and Complete Streets projects which increase mobility options for residents.

Examples of eligible projects and uses for this funding include the following:

- Road Maintenance and Rehabilitation

- Safety Projects

- Railroad Grade Separations

- Complete Streets Components (including active transportation, pedestrian and bicycle, transit facilities, and drainage and storm water capture projects in conjunction with any other allowable project)

- Traffic Control Devices

- Match for state/federal funds for eligible projects

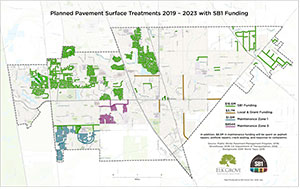

According to estimates provided by the League of California Cities, Elk Grove anticipates receiving $2,840,000 in FY 2018-19 for local streets and road maintenance. Thereafter, the revenues will increase over time. The current estimate is that the City will receive a total of $35 million over the first ten years of SB1 for the Local Streets and Roads Program. The funding over the first five years will allow the City to rehabilitate an additional 223 street segments or 86 lane miles of pavement within the City. Year one funding will be used to apply an asphalt overlay on Bond Road from East Stockton Boulevard to the Laguna Creek. This project is expected to cost $760,000. The City will add green bike lane markings at conflict points on Elk Grove Boulevard from Auto Center Drive to East Stockton Boulevard with the remaining funds.

But it's Not Enough...

Planned Pavement Surface Treatments

While this funding will help, it's not enough to keep up with Elk Grove's roadway maintenance needs. Elk Grove's Pavement Condition Index (PCI) is currently 74. Normal acceptable levels are 80 or above. Even with the infusion of SB1 funding, the City's overall PCI is expected to decline, albeit at a reduced rate, because the City's annual pavement repair need is $12.1 million while the existing funding and new funding will only add up to about $6.2 million per year ($3.2 million/year of existing funding + $3M of SB1 funding).

Guidelines for some programs are still under development by the CTC and there may be additional funding opportunities for the City not known at this time. The City continues to seek funding sources to fill the funding gap.

Contact

For general SB 1 information, please contact Mitchell Weiss, CTC Programming Deputy Directormitchell.weiss@dot.ca.govor by phone at (916) 653-2072.

For information about implementation and use of SB1 funding in Elk Grove, contact Public Works Director,Jeff Werner.

Additional Information:

The State Controller's Office has released SB 1 FAQ's that discuss use of funds and maintenance-of-effort.(SB1) Road Maintenance and Rehabilitation Program FAQs